Gold and cryptocurrency are two places where people can put their money.

As with many alternative asset classes, groups of high-profile, wealthy marketers promote the respective investment options.

In the competition of crypto vs. gold, the two representative groups of marketers are at distinct odds. Gold vs. crypto has become a vocal competition for wallet share.

A digital currency investing company called GrayScale had a website to convince people to drop gold (dropgold.com is no more).

After watching the following debate between respective gold and crypto marketers, I realized they each tell a similar marketing story. Still, there is a significant difference at the end of their stories.

From a pure marketing perspective, one of the story endings is more powerful (so far).

Story Telling in Marketing

If you are a marketer and have not read Building a StoryBrand by Donald Miller, add it to your reading list.

Stories can be a powerful marketing tool, but the problem with stories is that most marketers don’t know how to tell them.

Miller’s book explains exactly how to create a story for your brand. The StoryBrand BrandScript has these seven elements.

- A character

- Has a problem

- And meets a guide

- Who has a plan

- And calls them to action

- That helps them avoid failure

- And results in success

After you spend time learning about StoryBrand, the framework starts to present itself to you from all corners.

Donald Miller writes in his book, “Once you know the formulas, you can predict the path most stories will take. I’ve learned these formulas so well that my wife hates going to movies with me.” Miller says he keeps telling his wife precisely what will happen next in a movie’s plot.

As I watched this gold vs. crypto debate, the stories jumped out at me. Let’s examine the stories from the context of Miller’s StoryBrand framework.

1. A character

The character in this story is an individual investor, regardless of whether they have $100 to invest or $1 million to invest.

The investor character represents a vast market opportunity for purveyors of crypto and gold. Approximately 10% of Americans own gold as an investment, and about 16% have “invested in, traded, or otherwise used” cryptocurrency.

2. Has a problem

The investor’s external problem may be that they don’t have as much value in their owned assets as they would like.

They may either be concerned about losing purchasing power due to inflation or have aspirations of great wealth that they have not yet achieved. Either way, the “villain” in the story is a flat or depreciating asset portfolio.

An investor’s internal problem may be envying their neighbor’s beautiful lakefront vacation home. They want to own a bigger, more expensive vacation home than their neighbor. This level of problem may ultimately attract them to one story over the other.

3. And meets a guide

There are many guides in the gold and crypto worlds. Two of them are Peter Schiff (gold) and Richard Heart (crypto).

Mr. Schiff runs and markets SchiffGold, a company that sells physical gold and other precious metals. Schiff also markets a gold mining ETF through his company, EuroPacific Capital.

Mr. Heart runs and markets an altcoin company called HEX. Investors can stake the HEX coin for several years in a way that’s promoted as the blockchain equivalent of a bank’s certificate of deposit (CD). This staking is part of what makes HEX different from cryptocurrencies such as Bitcoin and Ethereum.

4. Who has a plan

In marketing, a plan generally answers the question, “How does it work?”

Hex.com has a menu item titled “How it Works” that links to a page titled “How HEX Works.”

SchiffGold.com answers the question in a homepage letter from Schiff to the visitor. There is also an explainer video.

5. And calls them to action

According to Miller, a website’s call to action should answer the question, “How do I get it?” Both Heart and Schiff answer that question in textbook format.

On HEX.com, the call to action is a bold button at the top right of the homepage (and interior pages) that reads, “How to Buy.” HEX.com’s “How to Buy” page spells out the four simple steps for buying HEX.

Schiff’s call to action is a homepage button that reads, “Get Started Today.” The “Get Started” page shows the four simple steps for buying and receiving physical precious metals.

6. That helps them avoid failure

This is where it gets more interesting. Schiff positions gold (and other commodities) as a hedge against inflation.

However, Schiff also emphasizes avoiding much more significant financial losses. According to Schiff, gold’s main competitors—cryptocurrencies—will eventually reach zero.

Heart’s version of failure is the outcome of keeping investment money in any relatively stagnant asset, including gold.

7. And results in success

Heart and other crypto marketers emphasize a [possible] future success scenario based on past success over a short period. This is one of the big marketing edges of crypto over gold.

It’s important to note that success is not promised—it’s left to potential investors to decide for themselves.

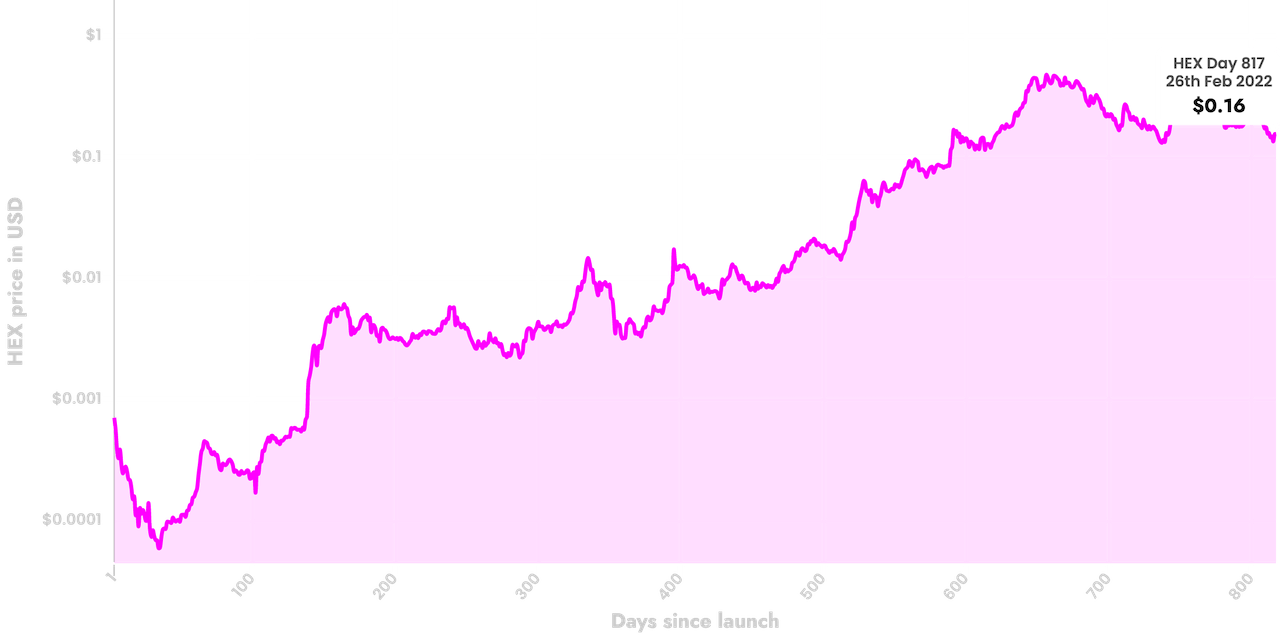

Charts paint a picture of success, and in the case of HEX, this shows a meteoric rise over a short period of time.

Heart cites several printed charts in the debate as proof of its success to date. Below is a snapshot of a chart from HEX.com.

Two points about the chart. The Y-axis shows a logarithmic price scale, which shows a smoother progression than a linear scale. The X-axis indicates the number of days rather than date ranges, meaning the viewer spends fewer mental calories.

The HEX website points out that the price of HEX appreciated 984,000% in 818 days. Anyone who purchased $105 of HEX at its low of $0.00006 would have become a millionaire.

The “success based on past performance” approach extends to other marketing media, including print ads, airport posters, and painted cars.

By necessity, Schiff frames success more subtly. Gold price charts don’t tell as compelling a part of the story regarding recent performance.

Over time, gold’s dollar value has grown, but it has grown much more slowly than crypto. Also, in 2010, Schiff suggested a future gold price of $10,000 on CNBC, and so far, that prediction has only come within about 33% of materializing.

In early 2025, the Bitcoin to Gold Comex ratio declined a bit.

What’s the Marketing Lesson Here?

Whether you believe that specific cryptocurrencies will go to zero or infinity, or whether you think gold will stay flat for the next decade or double in a year, this is an interesting case study for those who market more garden-variety products and services.

For many marketers, a B2B client’s future success is a less speculative proposition than the dollar price of cryptocurrency or gold. There is also less at stake financially.

For services businesses, the value we create is not as much based on what we have done as it is on what we will do — how well we can execute a plan for the next client.

Having said that, if an ascending chart of your past success is part of your marketing story, that may result in more sales conversations.